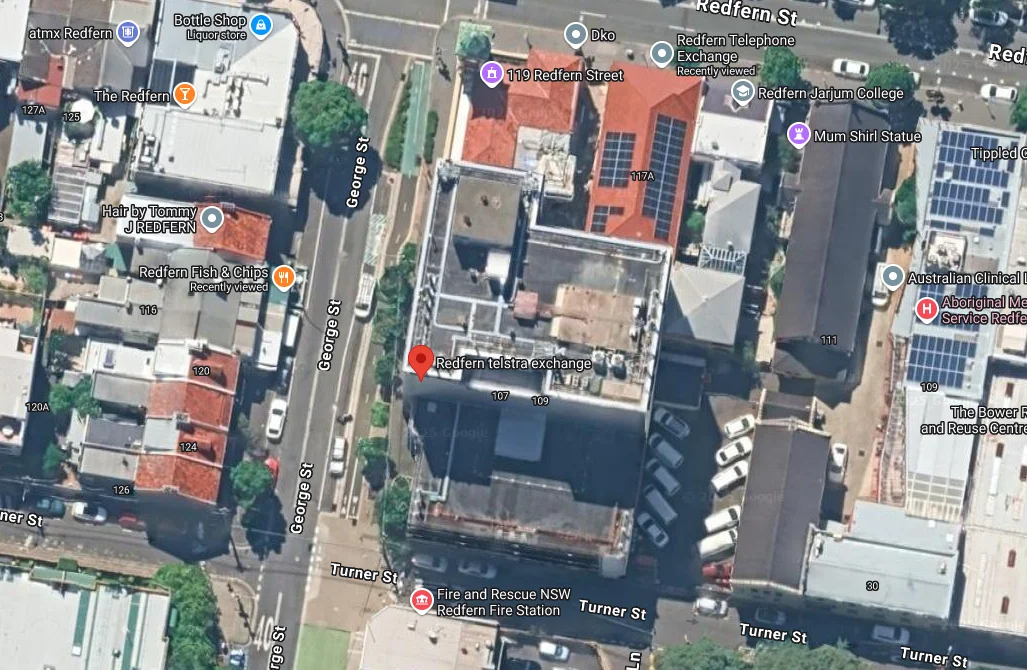

Telstra is set to partially decommission and sell part of its Redfern Telephone Exchange, offering a significant inner-city redevelopment opportunity. The 7-storey building at 103-109 George Street, sitting on a 1,260-square-metre block, is expected to fetch around $20 million through an international expressions of interest campaign.

Telstra has been gradually selling off commercial properties in recent years, including its 16-storey Sydney CBD building, which was sold to Charter Hall for $281 million in 2020. The company has also been divesting smaller suburban telephone exchanges as it modernises its telecommunications infrastructure.

The Redfern Exchange sale follows this trend, with Telstra opting for a sale-and-leaseback arrangement, allowing it to continue operations while transferring essential infrastructure to an adjacent building.

Redfern Exchange: Site Details and Redevelopment Potential

The Redfern Telephone Exchange at 103-109 George Street is a 7-storey, 4,000-square-metre building with protected 360-degree views, thanks to heritage restrictions on surrounding properties. The site is currently zoned E1 Local Centre, allowing for a range of redevelopment options (STCA), including:

- Residential housing

- Student accommodation

- Co-living spaces

- Traditional office spaces

- Medical developments

According to Knight Frank’s Will Brassil, the property’s current building envelope exceeds planning codes, making it a high-value asset for developers looking to capitalise on its existing structure and zoning flexibility.

Market Demand: Offshore Investors Show Interest

There has been renewed demand for inner-city development sites, particularly among offshore investors. Knight Frank’s Andrew Harford stated that interest from Southeast Asian capital is growing, leading to strong competition with local buyers.

Mr Harford also pointed to Knight Frank’s Australian Horizon 2025 report, which suggests that now is an optimal time to invest in commercial property, with market recovery expected from mid-2025.

What Happens Next?

The International Expressions of Interest campaign for the Redfern Exchange is expected to attract significant developer interest, given its prime location, existing infrastructure, and zoning flexibility. The sale is being managed by Knight Frank agents Will Brassil, Andrew Harford, and James Masselos, with advisory input from Charter Keck Cramer.

Once the sale and leaseback arrangement concludes, Telstra will fully decommission the site and finalise infrastructure relocation. The new owner will then seek approvals for redevelopment based on Sydney’s evolving property market demands.

Published 15-Feb-2025